Elements of Functional M&A Capability – Development to Improve Deal Success

In the past decade, M&A has become an increasingly important tool for companies to fuel growth, drive operational efficiencies, and enter new markets. While the use of M&A as a growth strategy has become more prevalent, the success rates of M&A transactions have remained stubbornly low. A number of studies have estimated that the failure rate of M&A transactions is between 70% and 90%.

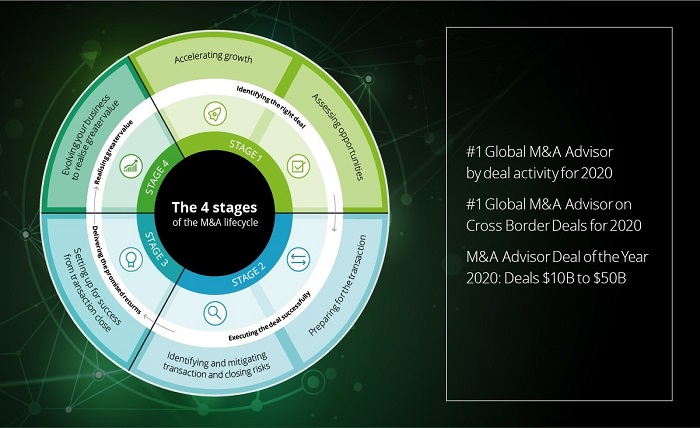

The high failure rate of M&A transactions is often attributed to the fact that M&A is a complex and risky undertaking. A successful M&A transaction requires a number of different capabilities, including the ability to identify attractive targets, to negotiate and structure deals, and to integrate the acquired business. Check out the capabilities of M&A Singapore for reference.

While there is no silver bullet for ensuring the success of an M&A transaction, there are a number of things that companies can do to improve their chances of success. In particular, companies should focus on developing a strong functional M&A capability.

What is Functional M&A Capability?

Functional M&A capability refers to a company’s ability to execute M&A transactions in a way that creates value. A company with strong functional M&A capability will be able to identify and assess potential acquisition targets, negotiate and structure deals, and integrate acquired businesses in a way that creates value for the company.

Developing a strong functional M&A capability requires a number of different things, including:

- The development of an M&A strategy that is aligned with the company’s business strategy

- The identification of the key functions that are critical to the success of M&A transactions

- The development of processes and procedures for executing M&A transactions

- The establishment of relationships with key M&A service providers

- The development of a robust due diligence process

- The identification of key value creation initiatives

- The establishment of performance metrics for measuring the success of M&A transactions

Why is Functional M&A Capability Important?

Functional M&A capability is important because it enables companies to execute M&A transactions in a way that creates value. A company with strong functional M&A capability will be able to identify and assess potential acquisition targets, negotiate and structure deals, and integrate acquired businesses in a way that creates value for the company.

In addition, companies with strong functional M&A capability are better positioned to weather the challenges that are inherent in M&A transactions. M&A transactions are complex and often involve a number of different challenges, including cultural differences, organizational challenges, and integration challenges.

Companies that have strong functional M&A capability are better equipped to manage these challenges and are more likely to be successful in M&A transactions.

How to Develop Functional M&A Capability

There are a number of things that companies can do to develop strong functional M&A capability. In particular, companies should focus on the following:

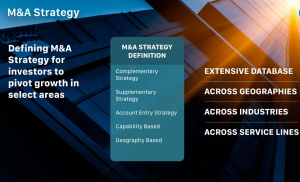

Develop an M&A Strategy

The first step in developing strong functional M&A capability is to develop an M&A strategy that is aligned with the company’s business strategy. The M&A strategy should set forth the goals and objectives that the company hopes to achieve through M&A activity.

In addition, the M&A strategy should identify the types of companies that the company should target for acquisition. The target company profile should take into account a number of factors, including the company’s business strategy, the company’s competitive position, and the company’s financial condition.

Identify Key Functions

The second step in developing strong functional M&A capability is to identify the key functions that are critical to the success of M&A transactions. There are a number of different functions that are involved in M&A transactions, including due diligence, deal structuring, and integration.

Each of these functions is critical to the success of M&A transactions. Companies should identify the functions that are most critical to their success and should develop the capabilities necessary to execute these functions effectively.

Develop Processes and Procedures

The third step in developing strong functional M&A capability is to develop processes and procedures for executing M&A transactions. The processes and procedures should be designed to ensure that M&A transactions are executed in a way that is consistent with the company’s M&A strategy.

In addition, the processes and procedures should take into account the key functions that are critical to the success of M&A transactions. The processes and procedures should be designed to ensure that these key functions are executed effectively.

Establish Relationships with Service Providers

The fourth step in developing strong functional M&A capability is to establish relationships with key M&A service providers. M&A service providers can provide a number of different services, including due diligence, deal structuring, and integration.

Companies should identify the service providers that are most critical to their success and should establish relationships with these service providers. In addition, companies should develop processes and procedures for working with service providers.

Develop a Robust Due Diligence Process

The fifth step in developing strong functional M&A capability is to develop a robust due diligence process. Due diligence is a critical function in M&A transactions. It is the process of investigating a potential acquisition target to assess the risks and opportunities associated with the transaction.

Companies should develop due diligence processes and procedures that are designed to identify the key risks and opportunities associated with a potential acquisition. In addition, companies should establish performance metrics for measuring the effectiveness of the due diligence process.

Identify Key Value Creation Initiatives

The sixth step in developing strong functional M&A capability is to identify key value creation initiatives. A value creation initiative is a project or initiative that is designed to create value for the company.

Companies should identify the value creation initiatives that are most critical to their success and should develop plans for executing these initiatives. In addition, companies should establish performance metrics for measuring the success of value creation initiatives.

Establish Performance Metrics

The seventh step in developing strong functional M&A capability is to establish performance metrics for measuring the success of M&A transactions. Performance metrics should be designed to measure the ability of M&A transactions to achieve the goals and objectives set forth in the company’s M&A strategy.

In addition, performance metrics should be used to measure the success of key value creation initiatives. By establishing performance metrics, companies can track the progress of M&A transactions and identify areas where improvement is needed.

Conclusion

Functional M&A capability is a critical success factor in M&A transactions. Companies that have strong functional M&A capability are better able to identify and assess potential acquisition targets, negotiate and structure deals, and integrate acquired businesses in a way that creates value for the company.

In addition, companies with strong functional M&A capability are better equipped to manage the challenges that are inherent in M&A transactions. As such, the development of strong functional M&A capability should be a key priority for companies that are looking to improve their chances of success in M&A transactions.